Press Release

Improved financing structures and implementation could help drive down the cost of the transition to net-zero in developing economies by nearly 40%

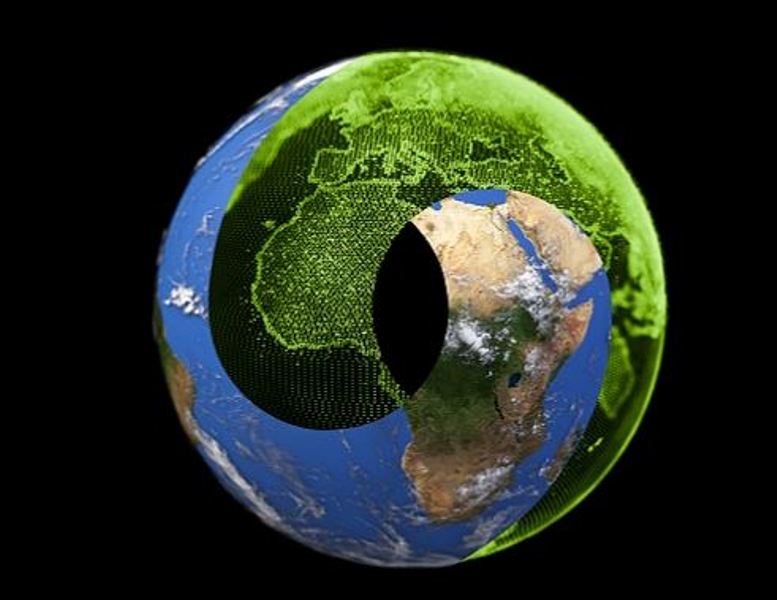

Ahead of the 2023 United Nations Climate Change Conference (COP28), taking place in Dubai (30 November – 12 December 2023), the globally leading professional services firm, Deloitte, released a report titled Financing the Green Energy Transition, showcasing that new cost-reducing finance instruments can help de-risk green projects in developing economies while making investing in these projects more attractive, helping to fuel a global just energy transition.

Achieving net-zero greenhouse gas emissions by 2050 will require an annual global investment in the energy sector ranging from US$5 trillion to US$7 trillion. However, the world currently invests less than US$2 trillion each year into the transition, which is far short of the financing needed to help put the world on course to meet our collective climate goals.

The report found that green projects currently suffer from underinvestment and high required return rates because private investors tend to see green technologies as riskier than alternative investments. The report highlights the need for governments, financial institutions, and investors to jointly develop mechanisms to help mitigate risk from green projects by developing blended, low-cost finance solutions to mobilize private investment and help achieve economic growth and climate neutrality—especially in emerging economies. It also highlights the benefits of taking action—the projected savings of US$50 trillion through 2050 could reduce the annual investment needed by over 25%. The report goes beyond finance to provide a holistic overview, employing analysis and modeling to consider the technology landscape, policy environment, and a matrixed vision of financing challenges.

“Just as we are continually developing solutions and technology to rapidly decarbonize, we must take definitive steps to remove financial barriers in order to accelerate a just energy transition, especially in developing economies,” says Jennifer Steinmann, Deloitte Global Sustainability and Climate practice leader. “Decisive and coordinated policy support and hand-in-hand action across the global finance ecosystem are critical to guiding investments toward green projects and supporting the growth of sustainable economies.”

To win the race to net-zero, the world must invest wisely and identify areas for cost reduction. For instance, less than half of green investments are currently made in developing economies mostly due to greater risks and stricter public budget constraints for energy transition projects. However, to reach net-zero, nearly three-quarters of green investments (70%) would need to be made in developing economies by 2030 as these nations look to new, sustainable infrastructures and technologies.

“To further lighten the financial burden on the Global South, governments, financial institutions and international organizations must implement concessional finance—a loan made on more favorable terms than the borrower could obtain in the market—through innovative financing structures that mobilize private capital for climate action,” says Hans-Juergen Walter, Global Financial Services Industry Sustainability and Climate leader. “Major financial institutions, such as development banks and multilateral funds, play a pivotal role in this context.”

To learn more about Deloitte’s 2023 Financing the Green Energy Transition report, click here.