The waste plastics value chain is a complex and dynamic sector, with an evolving operating environment. The general negative image of plastics is becoming increasingly global, driving the need for new legislation to increase recycling levels and the development of higher value end-use applications for recyclate. The plastics recycling industry therefore, has become the focal point for investments, acquisition, and expansion.

Although chemical recycling technologies currently dominate the news and attract the largest investments, mechanical plastics recycling and its importance should not be underestimated. The sector is attracting new stakeholders as well as seeing established players extend their presence within the sector. Indeed, mechanical recycling is also seeing large investments in new or expanding capacities.

Mechanical recycling capacity surpassed 54 million tonnes in 2022, and over 36 million tonnes of recyclate was produced globally. AMI Consulting estimates that mechanical recycling output will reach close to 55 million tonnes by 2030, an increase of 52% on 2022 volumes. That being said, the actual global recycling rate of commodity plastics is only anticipated to reach 16.5% by 2030, highlighting the vast opportunities within the industry.

While some regions, such as Europe and Northeast Asia are actively trying to reduce the use of excessive packaging, the increase of plastics usage in other areas, such as Africa and the Indian Subcontinent outweighs those efforts. The increase of plastics consumption in such regions is broadly driven by urbanization and growing middle classes and will contribute to increasing global plastics consumption for the foreseeable future.

Likewise, Europe and Northeast Asia also boost longstanding and relatively developed collection infrastructure for recyclables, albeit some volumes go to incineration as opposed to material recycling. In many other parts of the world, the informal sector plays a significant role in collecting post-consumer waste, mainly focusing on bottles and flasks. Unfortunately, other post-consumer applications, especially films or non-bottle rigid plastics still lack sufficient collection systems. Accordingly, PET has the highest recycling rate, 27.1% in 2022, primarily due to the well-established collection of PET bottles, through formalized collections, bottle deposit schemes, and the informal sector. The approval of food grade rPET is also gaining traction in countries across Northeast Asia, Southeast Asia, and the Indian Subcontinent, opening new opportunities for rPET use in higher value food grade applications.

Expanding on its highly successful 1st edition, AMI’s brand new 2nd edition report, Mechanical Plastics Recycling – The Global Market quantifies the market for mechanical recycling, analysing the supply and demand balance, along with an evaluation of current production by region.

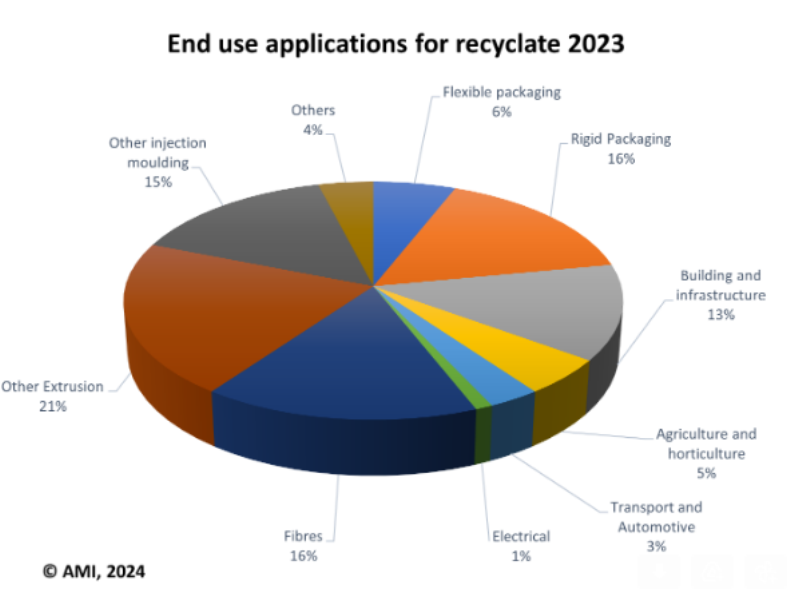

The report written by AMI’s Recycling and Sustainability Consultant, Elizabeth Carroll, also provides a detailed analysis of feedstock supply, the waste plastics value chain, and end-use applications for recyclate, with an examination of potential future absorption. It is relevant to all stakeholders in the plastics industry value chain, from resin producers to brand owners and end users of plastic products. The report delivers a comprehensive quantitative assessment of the current industry situation and forecasts where this critical aspect of the plastics industry will go in the future.

To request a free sample of this report, please click here. For further information about the report or how we can support your business, please visit our website at www.amiplastics.co.uk.