TGS, the leading global provider of energy data and intelligence, has released its latest quarterly Market Overview Report for global offshore wind, powered by 4C Offshore market intelligence. The report presents a complex outlook for the remainder of 2024 and beyond, with key factors like the upcoming U.S. elections, interest rate cuts, and supply chain improvements contributing to regained momentum after challenging years for the offshore wind industry.

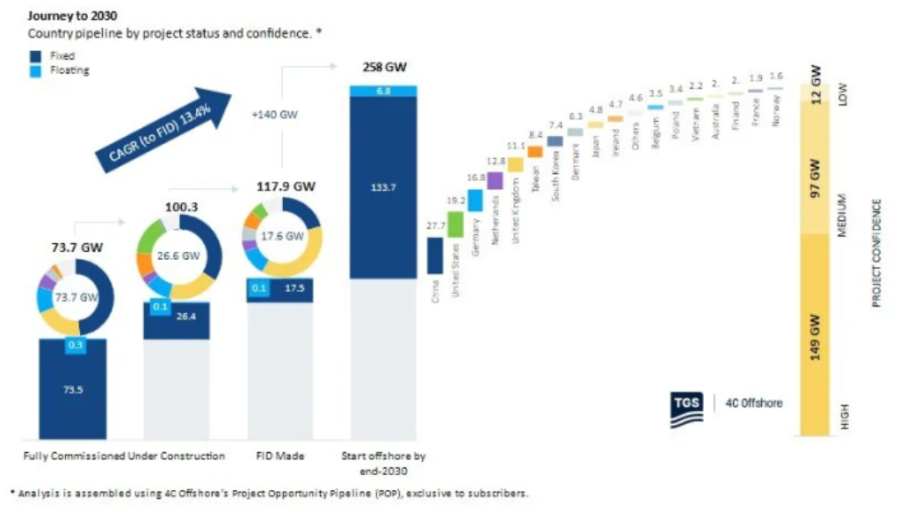

The global forecast shows 258 gigawatts of installed or in-progress offshore wind capacity by 2030, and the report emphasizes that while the sector is experiencing exciting growth, challenges remain.

In the third quarter of 2024, the offshore wind industry saw record-setting activity. A total of 21.3 gigawatts of fixed-bottom projects were awarded site licenses in Australia, Germany, and Taiwan. Additionally, a new record was set for permitting, with 17.5 gigawatts approved — up more than 16 gigawatts from the previous quarter and over 10 gigawatts higher than the third quarter of 2023.

This surge in permitting activity was driven in part by the United States, where the upcoming presidential election has spurred increased federal-level project approvals and leasing activity. The accelerated pace of approvals may be an effort to safeguard against potential policy changes following the election. For the first time, the U.S. holds second place, behind China, in the volume of capacity that has reached a financial close. While the U.S. is unlikely to meet its 30-gigawatt target by 2030, this activity solidifies its position as a key player in the global offshore wind market, regardless of the election outcome.

However, even positive news points to complications in the global pipeline. The UK’s Allocation Round 6 (AR6) showed improvement over last year’s AR5, when no offshore wind bids were submitted, and set Green Volt on track to become the first commercial-scale floating wind farm. Despite this, 4C Offshore analysis reveals that only 3.4 gigawatts of the 6.2 gigawatts of awarded capacity is for projects not previously awarded under the scheme. The UK currently has 14.8 gigawatts fully commissioned and is targeting 60 gigawatts (including 5 gigawatts of floating wind) by 2030. The latest results fall short of what’s needed to meet these ambitious goals. In fact, based on the awarded capacity, this marks the lowest auction result since Allocation Round 2 in 2017, excluding reductions and AR5.

The report also highlights significant disruptions to the offshore wind status quo—one of the major challenges centers around wind turbines and the evolving supply chain landscape. European turbine manufacturers are grappling with production issues, while Chinese models continue to grow in size. The installation of a 20-megawatt turbine in China has attracted attention, particularly as European developers increasingly engage with Chinese original equipment manufacturers, prompting a response from the European Union. Meanwhile, American and European OEMs have been dealing with technical failures, with Vestas calling for the industry to slow its push toward ever-larger turbines.

The Q3 2024 Market Overview Report is available for subscribers to 4C Offshore market intelligence. Visit 4coffshore.com for more information or to request a copy.