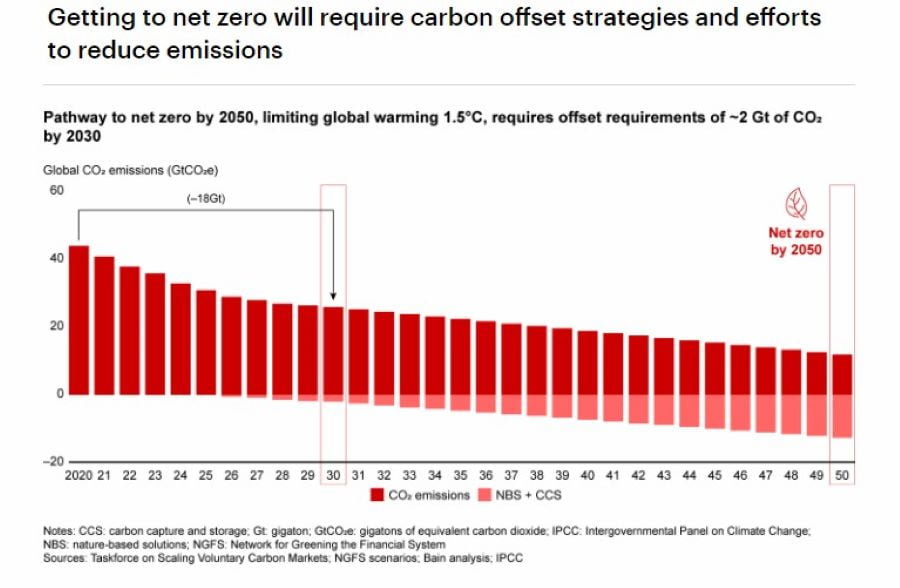

A new brief has been published by Bain & Company, that showcases the value and the need for voluntary carbon markets in order for governments and other stakeholders to achieve their climate ambitions. It highlights how Gulf Cooperation Council (GCC) countries will not only need to develop and scale up new technologies, but also access mitigation projects outside their own value chain if they are to achieve their own stated climate ambitions.

Leading GCC economies have announced ambitions to reach net zero emissions (the Kingdom of Saudi Arabia by 2060, and the United Arab Emirates and Oman by 2050) and have revised their 2030 climate commitments under the Paris Agreement. They intend to achieve these ambitions with decarbonization strategies that rely on a mix of well-established levers (e.g. renewable energy and energy efficiency) plus forward-looking carbon abatement solutions (e.g. clean hydrogen and carbon capture).

This is where the voluntary carbon market will be key. In essence, it connects the supply of carbon credits with demand from organizations wanting to reduce their carbon. While there have been several example initiatives in the region, such as the establishment of exchanges, the practice is still in its infancy in the GCC and there is limited demand and supply compared to other regions.

“There is mounting urgency for swift action to reduce greenhouse gas emissions. What is clear is that to achieve net-zero a combination of mature and early-stage solutions will be required. Energy efficiency and renewable energy alone will not be sufficient for GCC nations to achieve their climate ambitions,” said Raja Atoui, a Partner at Bain & Company Middle East.

According to Atoui, hard-to-abate-sectors, such as aviation and cement, across the region face a dilemma as there are limited cost-efficient emission reduction solutions available to them. Participation in the voluntary carbon market can play a significant role in accelerating their progress on decarbonization efforts.

“It is imperative for GCC governments to establish the infrastructure for the voluntary carbon market, as well as to clarify carbon ownership, a critical step if countries wish to align private sector efforts and capital allocation with their government’s sustainability plans. Going further, the provision of clear certification guidelines will provide investors with required clarity to make guided decisions”, said Othmane Boujemaoui, an associate Partner at Bain & Company Middle East.

With the focus on net zero driven by the highest levels of government in the region, leading industrial players will ultimately be driven to operate in the voluntary carbon market, even if it currently lacks maturity and transparency.

“Now is the right time to start building internal voluntary carbon market capabilities, including the development of an optimal operating model and strategic recruitment strategies to minimize the risk of misallocated capital,” advises Boujemaoui.

To read the report in full, please visit Bain & Company.