Press Release

The global Emissions Trading Market size was valued at $334.80 billion in 2023 and is expected to reach $1,510 Billion by 2030, grow at a compound annual growth rate (CAGR) of 24% from 2023 to 2030, according to a new report by Coherent Market Insights, Inc. Emissions trading is an approach to controlling pollution and reducing greenhouse gas emissions. It is used to reduce or control pollution to protect human health and the environment. An emissions trading system allows countries and companies that emit greenhouse gases into the atmosphere to buy/sell these emissions among themselves. Emissions trading works by setting the environmental goal, national or sometimes regional. Such programs provide affected sources with the flexibility to choose among many options to comply with the environmental goal. Emissions trading is a cost-effective way of reducing greenhouse gas emissions.

Key Trends and Analysis of the Global Emissions Trading Market:

Increasing adoption of carbon pricing mechanisms or systems is one of the key trends expected to augment the growth of the global emissions trading market. For instance, more countries or regions across the globe are implementing carbon pricing mechanisms, such as emissions trading systems, to control or reduce greenhouse gas emissions. Carbon pricing (CO2 pricing) is a method/approach used to address climate change. Its overarching goal is to protect the environment, discourage the use of carbon dioxide-emitting fossil fuels, and address the causes of climate change to meet both the national or international climate agreements.

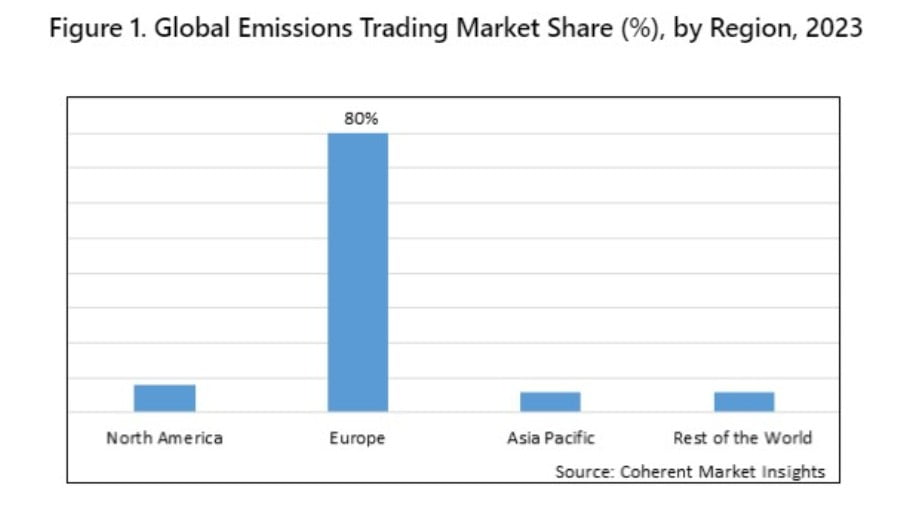

Several governments around the world have adopted norms to promote the use of emissions trading programs or systems. For instance, EU ETS is a cornerstone of the EU’s policy to combat climate change and its key tool for reducing greenhouse gas emissions cost-effectively. EU ETS represents over 90% of the global compliance carbon markets and in 2022 traded volume amounted to 9,277 MtCO2e representing €751.5 billion in value. The EU ETS is expected to continue to grow in the coming years, as the European Union (EU) commits to reducing its greenhouse gas emissions by 55% by 2030. This in turn is expected to drive market growth.

Increasing carbon emissions to augment the market growth

With the rapid growth in carbon emissions (also referred to as greenhouse gas or GHG emissions) across the globe, the implementation of emission trading program or system is also increasing with the rapid pace. According to the International Energy Agency (IEA), global carbon dioxide (CO2) emissions from energy combustion and industrial processes grew 0.9% or 321 Mt in 2022 to a new all-time high of 36.8 Gt. The lobal energy-related carbon dioxide emissions rose by 6% in 2021 to 36.3 billion tons, their highest ever level, as the world economy rebounded strongly from COVID-19 crisis and relied heavily on coal to power that growth.

Click here for the full release and access to the full market research report, “Emissions Trading Market Size, Share, Growth, By Emission Trading Scheme (ETS) Type, By Geographical Coverage, By Covered Sectors, By Tradable Emission Units, Outlook, and Opportunity Analysis, 2023 – 2030”, published by Coherent Market Insights.