According to a new report by the International Energy Agency (IEA) and International Finance Corp (IFC), a surge in spending on clean power, grids, storage, and efficient technologies is needed over the next decade to meet rising energy needs and to reach climate goals.

The report, Scaling Up Private Finance for Clean Energy in Emerging and Developing Economies, “shows that public investments alone would be insufficient to deliver universal access to energy and tackle climate change. Increased public funding can be used most effectively in partnership with private sector capital to reduce project risks – a concept known broadly as blended finance,” an IEA press release read.

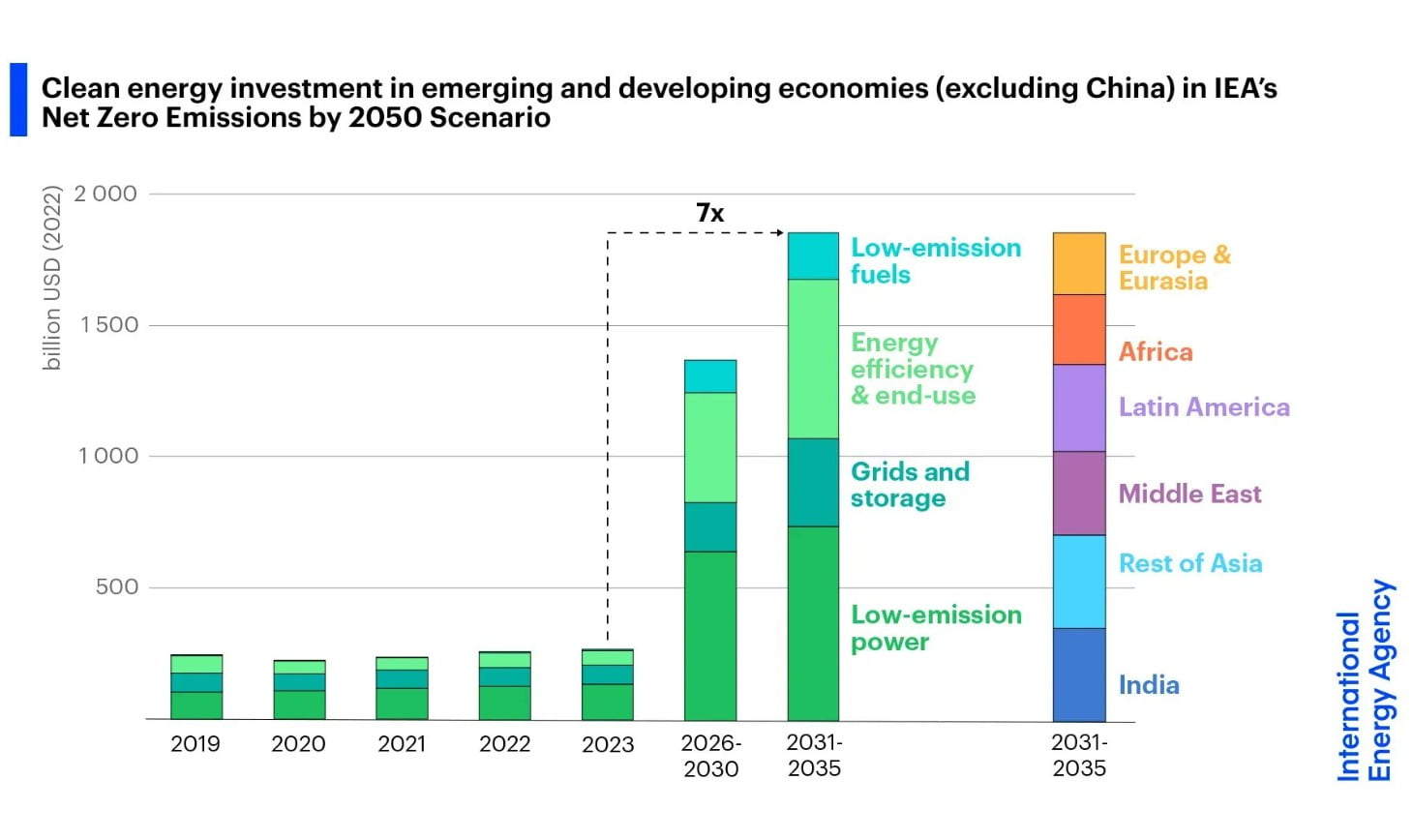

It further stated that “two-thirds of the finance for clean energy projects in emerging and developing economies (outside China) will need to come from the private sector. Today’s $135 billion in annual private financing for clean energy in these economies will need to rise to as much as $1.1 trillion a year within the next decade.

“Today’s energy world is moving fast, but there is a major risk of many countries around the world being left behind. Investment is the key to ensuring they can benefit from the new global energy economy that is emerging rapidly,” said IEA Executive Director Fatih Birol. “The investment needs {to} go well beyond the capacity of public financing alone, making it urgent to rapidly scale up much greater private financing for clean energy projects in emerging and developing economies…”

While there will be some pain points along the way, Birol went on to say that scaling up investment “offers many advantages and opportunities – including expanded energy access, job creation, growing industries, improved energy security and a sustainable future for all.”