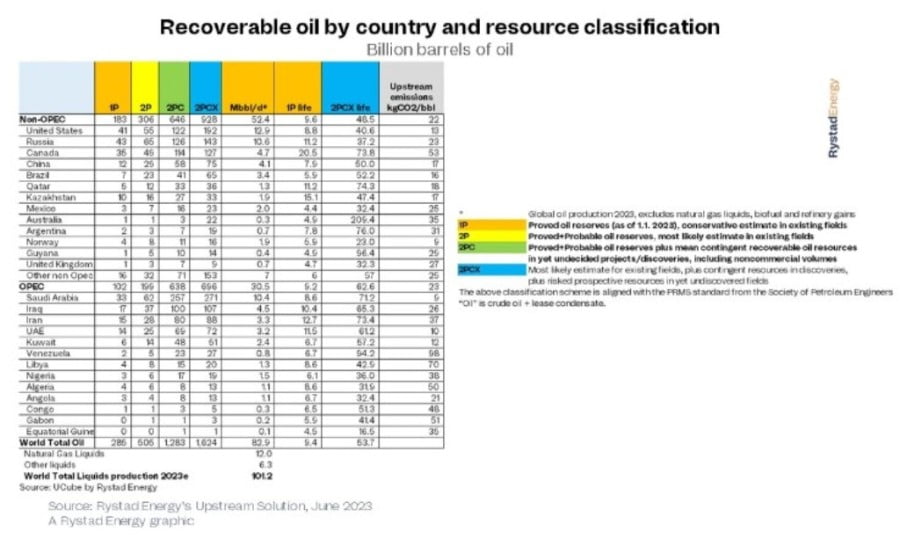

Total global recoverable oil reserves now stand at 1,624 billion barrels, according to Rystad Energy research, an increase of 52 billion barrels from our last year’s estimate. In a scenario where global warming is limited to 1.9°C, this oil will contribute about 0.2°C of additional warming by 2100*. Therefore, about 20% of any additional warming will come from burning oil in cars, ships and airplanes and all other uses that lead to greenhouse gas (GHG) emissions.

Emissions from oilfield operations are estimated at 5% of all crude-related emissions. The industry is working actively to reduce the intensity of upstream emissions, which can vary from 10 kilograms of carbon dioxide per barrel of oil (kgCO2/barrel) in Saudi Arabia to more than 100 kgCO2/kg in heavy oil fields in Venezuela.

Every year, Rystad Energy shares an update of its analysis of the global energy landscape and provides an independent, data-based evaluation of the world’s recoverable oil reserves. Recoverable oil corresponds to the industry term ‘remaining technically recoverable crude oil and lease condensate’, i.e. expected volumes, including fields, discoveries and risked future discoveries.

Since our 2022 report, 30 billion barrels of crude oil have been extracted, the same level seen in 2018 and 2019, with 84 billion barrels added in fields, discoveries and exploration prospects. Increased reserves in producing fields and approved projects in 2022 amount to 71 billion barrels, while 13 billion barrels were found in new discoveries during 2022, equaling a net total addition of 54 billion barrels.

Although 1,624 billion barrels of oil are technically recoverable, fewer than 1,300 billion barrels are likely to be economically viable before 2100 at an average Brent price of $50 per barrel. The potential longevity of proven reserves varies widely among OPEC and non-OPEC producers, ranging from fewer than five years for the UK to more than 20 years for Canada. Iran leads OPEC members with almost 13 years of proven reserves.

“The upstream sector is working hard to reduce greenhouse gas emissions from oilfields. However, even with these mitigation measures and governmental efforts, if global warming is to be successfully limited to 1.6°C, only half of the world’s recoverable reserves would be required. It’s not unreasonable to conclude that policies and technological advances can reduce oil consumption and boost the energy transition, bringing us closer to a 1.6°C scenario,” says CEO Jarand Rystad.

*Assuming one barrel of oil emits 400 kg CO2, 85% of oil is burnt and 222 GtCO2 emitted leads to 0.1°C warming, ref IPCC AR6 SPM D.1.1: “best estimate for TCRE is 0.45 degree per 1000 GtCO2”. Methane emissions are disregarded.

One key driver of waning oil demand is the surge in electric vehicle (EV) sales. We estimate EV sales will continue to accelerate and pass 50% of global car sales by 2030, leading to peak oil demand of 105 million barrels per day (bpd) by 2026 before tapering at above 100 million bpd until 2032.

Saudi Arabia unsurprisingly leads the way in total recoverable oil with 271 billion barrels. The US follows with 192 billion barrels, Russia with 143 billion barrels and Canada with 127 billion barrels. Iraq and Iran round out the top six with 107 and 88 billion barrels, respectively. China saw a significant jump from last year due to the de-risking of technically recoverable shale resources, with total reserves now estimated at 75 billion barrels. New estimates on Daqing producing fields and recent developments in Xinjiang province and in the Tarim petroleum basin have together boosted the Asian giant’s resources.

Rystad Energy estimates reserves and resources according to the widely recognized standard called Petroleum Reserves Management System (PRMS). The PRMS standard distinguishes between three classes of likelihood (P1, P2 and P3) and three classes of development maturity (Producing plus Approved, Discovered and Undiscovered). The table below groups remaining recoverable crude oil resources into five main categories: Proved, Probable, Expected, Contingent and Prospective.

The timestamp of Rystad Energy’s newest resource assessment is January 1, 2023. In other words, our analysis illustrates where the remaining recoverable resources of each country stood at the beginning of this year.

See the full release with charts and data here.